How to Negotiate a Car Price in the UAE - Insider Tips

Tags:

Buying a car in the UAE? Negotiation is key to saving thousands of dirhams. Whether you’re after a new or used vehicle, understanding the UAE market, timing your purchase, and using tools like YallaMotor can help you secure the best deal. Here’s what you need to know:

-

Research Prices: Use YallaMotor’s valuation tool to check market values based on the car’s make, model, year, and condition.

-

Timing Matters: Shop during Ramadan, year-end sales, or the end of a dealer’s quarter for better offers.

-

Set a Budget: Include VAT (5%), registration fees, insurance, and maintenance in your calculations.

-

Inspect Thoroughly: Check the car’s condition, service history, and warranties. Consider a professional inspection for used cars.

-

Negotiate Smartly: Start with a reasonable offer and focus on the total cost, not just the sticker price. If the price is firm, ask for add-ons like warranties or service packages.

-

Avoid Dealer Tactics: Watch for hidden fees and pressure tactics. Always get agreements in writing.

Understanding depreciation rates and leveraging seasonal promotions can give you an edge. With the right approach, you can confidently negotiate and avoid overpaying.

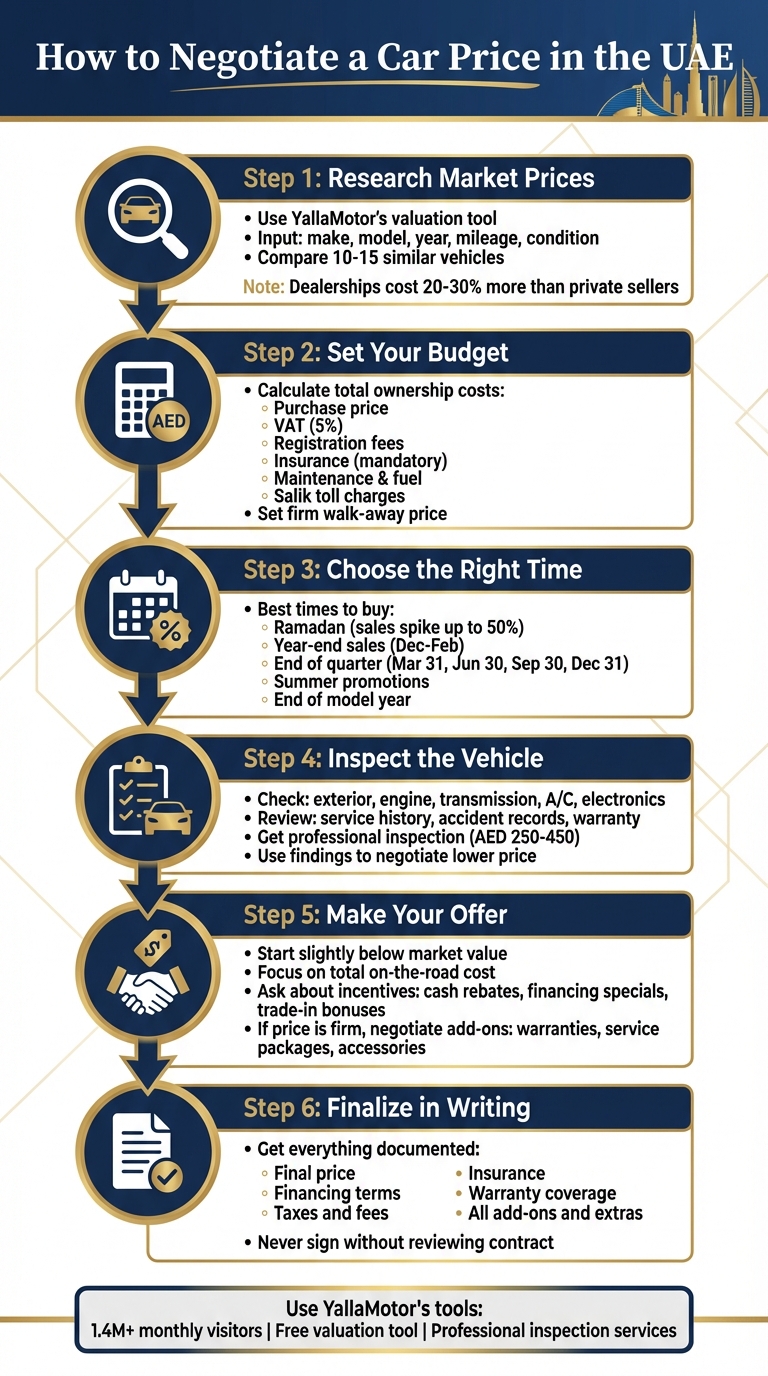

6-Step Car Price Negotiation Process in UAE

How To NEGOTIATE Your Vehicle Purchase in 2025!

Research Market Prices Using YallaMotor Tools

Before stepping into negotiations, it’s crucial to do your homework. Understanding your car’s market value is the foundation for securing a fair deal in the UAE. This is where YallaMotor's tools come in handy, making the research process straightforward and effective.

How to Use YallaMotor's Car Valuation Tool

YallaMotor's Car Valuation Tool eliminates the guesswork from pricing. Simply input the car’s make, model, year, transmission type, and trim. For example, if you're valuing a 2022 Toyota Land Cruiser VXR, it’s essential to differentiate it from a 2022 Land Cruiser GXR to get an accurate estimate.

Next, add details like the car’s mileage and overall condition. A car with 50,000 km and a well-documented service history from an authorised dealership will generally fetch a higher price than one with 100,000 km and inconsistent maintenance records. The tool uses these factors, along with up-to-date market data, to calculate a valuation range. It even considers local depreciation trends.

Don’t forget to include optional features like a panoramic sunroof or a premium sound system, as these can significantly impact the car’s value. By providing all these details, you’ll get the most precise valuation possible.

Once you’ve got your valuation range, you can move on to comparing prices across the market to refine your understanding.

Compare Prices for New and Used Cars

With your valuation range in hand, the next step is to explore actual market prices. YallaMotor’s platform, which attracts over 1.4 million visitors each month, offers a wide selection of listings. Search for vehicles that match your criteria and take note of the asking prices from both private sellers and dealerships.

To make sense of the data, consider creating a simple spreadsheet. Track details for 10–15 comparable vehicles, including their asking prices, mileage, condition, and how long they’ve been listed. Cars that sit unsold for a long time might be overpriced, while those that sell quickly often reflect competitive pricing. This exercise will help you identify the typical price range and spot any anomalies, such as hidden issues or opportunities for negotiation.

Keep in mind that cars sold by dealerships tend to cost 20–30% more than those sold privately. This is often because dealerships include warranties and after-sales support. By factoring in these differences, you can set a realistic target price and a firm maximum limit, ensuring you negotiate with confidence and avoid overpaying.

Set a Budget and Determine Your Walk-Away Price

Before stepping into negotiations, it's crucial to have a clear financial game plan. This means accounting for more than just the sticker price - think total ownership costs and setting a firm upper limit you won’t exceed.

Calculate Total Ownership Costs

The purchase price is just the tip of the iceberg. Start by reviewing your monthly income and expenses to figure out what you can comfortably allocate toward car-related costs.

Be sure to include VAT (5%), registration fees, comprehensive insurance (mandatory for vehicle registration), routine maintenance, fuel expenses, Salik toll charges, and any initial maintenance work the car might need. Don’t forget to account for depreciation as well. For example, electric vehicles and hybrids tend to hold their value better due to increasing interest in eco-friendly options. On the other hand, cars with over 100,000 km on the odometer often face significantly reduced resale values.

Ask the seller for a detailed breakdown of all costs, including fees and add-ons, to avoid any unexpected surprises. Once you’ve mapped out these expenses, you’ll have a clearer picture of what you can afford - and can set a firm spending limit.

Set Your Walk-Away Price

Using your research and total cost calculations, determine your maximum budget. This walk-away price, set in AED, is the absolute amount you’re willing to pay - no exceptions.

Your YallaMotor research will be invaluable here. Use tools like valuation results and comparable listings to ensure your limit aligns with the car’s market value, condition, and your financial capabilities.

If financing the purchase, consider getting pre-approval from a UAE bank to streamline the process.

Choose the Right Time to Negotiate

Timing plays a crucial role when negotiating car prices in the UAE. Dealerships operate on sales cycles, quotas, and inventory pressures, and understanding how these factors align can help you save thousands of dirhams.

Take Advantage of Seasonal and End-of-Period Discounts

Ramadan and Eid are some of the best times to find great car deals in the UAE. Dealerships often roll out aggressive promotions to match the festive buying spirit. For example, during Ramadan 2025, Mitsubishi (Al Habtoor Motors) offered a package that included free fuel for up to two years, free insurance, zero down payment, and a five-year unlimited kilometres manufacturer warranty. Sales during Ramadan can spike by up to 50%, making dealers more eager to close deals.

Year-end sales, spanning December through February, also provide excellent opportunities. Dealerships aim to clear out older inventory before new models arrive, offering discounts, lower interest rates, free registration, and service packages. These promotions often extend into mid-January or even February, giving you an extended window for negotiation. December, in particular, is known globally for having the highest daily vehicle sales, making it an opportune time to strike a deal.

Summer promotions are another good option. With fewer people visiting showrooms due to the extreme heat, dealerships often introduce attractive offers such as zero down payment and free service packages to lure buyers.

These seasonal trends create a favourable environment for leveraging dealer quotas, further strengthening your position during negotiations.

Use Dealer Incentives and Inventory Cycles to Your Advantage

Beyond seasonal timing, understanding dealer quotas can give you an edge. Dealerships operate on quarterly sales quotas, ending on 31 March, 30 June, 30 September, and 31 December. Sales teams are often under pressure to meet these targets, especially as the quarter comes to a close. As Koshy explains:

As dealerships have quarterly sales quotas to reach, you often find more promotions offered in order to meet their targets.

Shopping during the final week of any quarter can work to your advantage, as dealers may be more willing to negotiate aggressively to hit their numbers.

The end of a model year is another great opportunity. When new or redesigned models hit the market, dealerships need to clear out older stock to make room for incoming inventory. Ibrahim Riba, a Senior Salesman at a car dealership in Abu Dhabi, notes:

While December has the highest daily selling rate for vehicles worldwide compared to any other week throughout the year, there is room for better deals on current models even after the new year's models are on the lot ready to be sold, especially ones being redesigned or discontinued.

This applies to both new and used vehicles. When a new model is launched, previous versions often see price reductions. Keep an eye on model release dates, which are usually towards the end of the year, and time your purchase to take advantage of dealers’ urgency to move older stock.

Inspect the Vehicle and Use YallaMotor Services

Taking the time to inspect a vehicle thoroughly can either give you leverage to negotiate a better price or help you decide to walk away from a deal that’s not worth it.

What to Inspect Before Negotiating

Start with the vehicle’s exterior. Look for dents, scratches, rust, or any signs of repainting, as these could indicate past accidents. A simple trick? Use a weak magnet to check for body fillers, which might hint at repairs. Don’t forget to examine the tyres, brakes, suspension, lights, and the engine bay. When inspecting the engine, make sure you’re in good lighting and listen carefully for any unusual noises. If the car has an automatic transmission, check the transmission fluid with a tissue - dark fluid or a burnt smell could spell trouble. Also, test the A/C and electrical features like the infotainment system, cruise control, and sunroof. These are especially important in the UAE’s climate.

Inside the car, pay attention to the dashboard. Warning lights like Check Engine, temperature, oil, or airbag indicators should not be ignored. Ask the seller about the vehicle’s accident history, verify the mileage, and check ownership and service records. Don’t forget to confirm if the manufacturer’s warranty is still valid and transferable. If all this feels overwhelming, getting a professional inspection is a smart move.

Get a Professional Inspection Through YallaMotor

A professional inspection can uncover hidden problems and give you a stronger position in negotiations. Before finalising any deal, consider having the car professionally inspected. This service usually costs between Dh250 and Dh450, but it’s worth it. These detailed reports often reveal issues like mechanical faults, structural damage, or safety risks (think faulty brakes or defective airbags) that sellers might not mention.

Use the inspection report to back up your negotiations. A good strategy is to agree on a tentative price, then get the car inspected. If no issues are found, the seller might stick to the agreed price. But if problems arise, you’ll have solid evidence to push for a discount. And if the seller refuses to adjust the price despite significant issues, be ready to walk away - it’s better than ending up with a costly mistake.

Make Your Offer and Negotiate Add-Ons

Once you've completed your inspection and research, it's time to make your move. Approaching the negotiation with a clear strategy can help you secure a fair deal.

Start with a Reasonable Offer

Kick things off with an offer slightly below the market value. This gives you some flexibility to negotiate upwards. Your offer should be based on solid research - consider factors like the car's make, model, year, mileage, condition, and current market prices for similar vehicles. If you've identified any issues, such as defects or missing records, use them as bargaining points to justify a lower price.

Avoid going too low, though. A drastically low offer could offend the seller and derail the negotiation altogether. When discussing price, focus on the total on-the-road cost, which includes fees, taxes, and any extras. Ibrahim Riba, a Senior Salesman at a car dealership in Abu Dhabi, advises:

The purchase price is often the only advertised or broadcasted figures at car dealerships. But that doesn't paint a crystal clear picture for your finances. Ask about the car's price, financing options, interest rates, taxes, and additional fees.

Don’t forget to inquire about potential incentives. Atif Asgar, an Automotive Analyst in Dubai, highlights:

Dealerships may offer cash rebates, financing specials, or trade-in bonuses. Manufacturer offers vary but could include low-interest financing or zero-down payment options.

These incentives can make a noticeable difference in your overall cost and lay the groundwork for negotiating extras.

Negotiate Add-Ons Separately

If the seller won’t budge on the car's price, shift your focus to the extras. In the UAE, common negotiation points include extended warranties, service packages, accessories like new tyres or floor mats, and paint protection. Insurance packages can also be part of this discussion, but stick to what you genuinely need.

Be clear about which add-ons are essential and compare prices elsewhere. For instance, window tinting offered by showrooms can cost thousands of dirhams, while local distributors might provide more affordable options. If an add-on isn’t necessary, don’t hesitate to decline it. For used cars, check if the manufacturer's warranty is still valid and transferable. Typically, basic warranties cover three years, while powertrain warranties can extend up to five years.

Lastly, ensure all terms are documented, especially agreements on repairs, servicing, or additional extras. Having everything in writing protects you from any misunderstandings and ensures the deal reflects what was agreed upon.

Handle Dealer Tactics with Confidence

Car dealerships often use specific strategies to tip negotiations in their favour. The key to staying in control is recognising these tactics and responding effectively. Here's how you can navigate these situations with confidence.

Spot and Respond to Common Pressure Tactics

One popular strategy is shifting the conversation to monthly payments instead of total costs. While lower monthly instalments might sound appealing, they can disguise a higher overall cost due to extended loan terms and added interest. If a dealer avoids providing a full price breakdown, take it as a warning. Always focus on the total on-the-road price, which should include everything - 5% VAT, registration, insurance, and any extras.

Another trick is creating a sense of false urgency with statements like, "This deal ends today" or "Another buyer is interested." These are designed to pressure you into making a rushed decision. Instead, slow things down. Set a time limit for your visit and stick to it. Remember, genuine offers don’t vanish overnight.

Be mindful of hidden fees and unnecessary add-ons that can creep into the final contract. Before you step into the showroom, request an itemised price breakdown in writing. Negotiate the car's price separately from financing and trade-ins, and consider getting pre-approved for an auto loan from your bank. This way, you can avoid inflated interest rates offered by the dealership.

Once you’ve addressed these tactics, protect yourself further by documenting all agreed-upon terms.

Secure All Terms in Writing

Ensure every detail of your agreement is clearly documented. This includes the final price, financing terms (interest rates and monthly payments), taxes, fees, insurance, trade-in value, warranty coverage, and any extras like paint protection or service plans. For used cars, double-check the warranty terms.

Having everything in writing helps avoid misunderstandings and shields you from surprise costs. Dourado Luxury Car highlights the importance of this:

Once you've reached an agreement with the dealership, make sure to get everything in writing. This includes the final price, any agreed-upon incentives, and the terms of the sale.

If a dealer hesitates to put terms in writing, consider it a red flag. Never sign anything without thoroughly reviewing the contract to ensure it aligns with what was discussed. Protect yourself by staying vigilant and informed.

Conclusion: Getting the Best Deal in the UAE

Negotiating effectively in the UAE can save you a significant amount of dirhams. The key lies in being well-prepared, conducting thorough market research, and setting a clear budget. Don’t forget to factor in additional costs like the 5% VAT, registration fees, insurance, and maintenance expenses, as these can add up quickly. A professional vehicle inspection is also a smart move, as it gives you leverage during negotiations.

Timing plays a big role too. Dealers often aim to meet sales targets at the end of the month or quarter, which can work in your favour for securing better deals. Additionally, understanding the UAE’s car market - known for its high depreciation rates - can help you set realistic price expectations and spot genuine bargains.

To wrap up your strategy, YallaMotor’s valuation tools are a game-changer. These tools help you determine the fair market value of a car, compare prices across thousands of listings, and even schedule a professional inspection. With these resources, you’ll be well-equipped to negotiate with confidence and get the deal you deserve.

FAQs

When is the ideal time to buy a car in the UAE to get the best deals?

The ideal time to buy a car in the UAE is often during Ramadan, as dealerships tend to offer enticing promotions. These can include discounts, cashback deals, zero down payments, or extended warranties, making it a popular season for car buyers.

Another smart period to consider is the end of the year or the end of a quarter. During these times, dealers are keen to meet sales targets and clear out inventory, which means you might come across reduced prices, added perks, or attractive financing plans. Timing your purchase during these windows can lead to noticeable savings.

How can I use YallaMotor's tools to negotiate the best car price in the UAE?

YallaMotor provides some excellent tools to help you approach car negotiations with confidence in the UAE. Start by diving into the platform to check current market prices and compare similar vehicles. This will give you a clear idea of what a fair price looks like. Their valuation calculators are particularly useful for pinpointing the right price for both new and used cars.

You can also browse through localised listings to spot competitive deals. Plus, detailed vehicle histories and expert reviews are available to give you a deeper understanding of a car's value. Armed with this knowledge, you'll be better prepared to negotiate and lock in a deal that works best for you.

What dealer strategies should you be aware of when negotiating a car price in the UAE?

Dealers often have a few tricks up their sleeves to maximise their profits, but knowing these can give you the upper hand during negotiations. Here are some common strategies to watch out for:

-

Starting with inflated prices: It's not unusual for dealers to kick things off with a higher price, giving themselves room to negotiate. To counter this, research the car's market value beforehand so you know what it’s truly worth.

-

Mixing trade-ins with the car price: By bundling your trade-in value with the cost of the new car, dealers can make it tricky to figure out if you're getting a fair deal. A smarter move? Negotiate the trade-in and car price as separate transactions.

-

Pushing extras you don’t need: Add-ons like extended warranties, insurance packages, or fancy accessories may sound appealing, but they can quickly inflate the final bill. Be clear on what you need and skip the unnecessary frills.

-

Keeping manufacturer promotions under wraps: Dealers might not always tell you about cashback offers or discounts provided by the manufacturer. Always ask if there are any ongoing promotions or incentives you can take advantage of.

By recognising these tactics and staying up-to-date on car market trends in the UAE, you’ll be better equipped to land a deal that works in your favour without overspending.

Looking for a used car in Dubai or new car deals? Explore YallaMotor’s verified listings today.