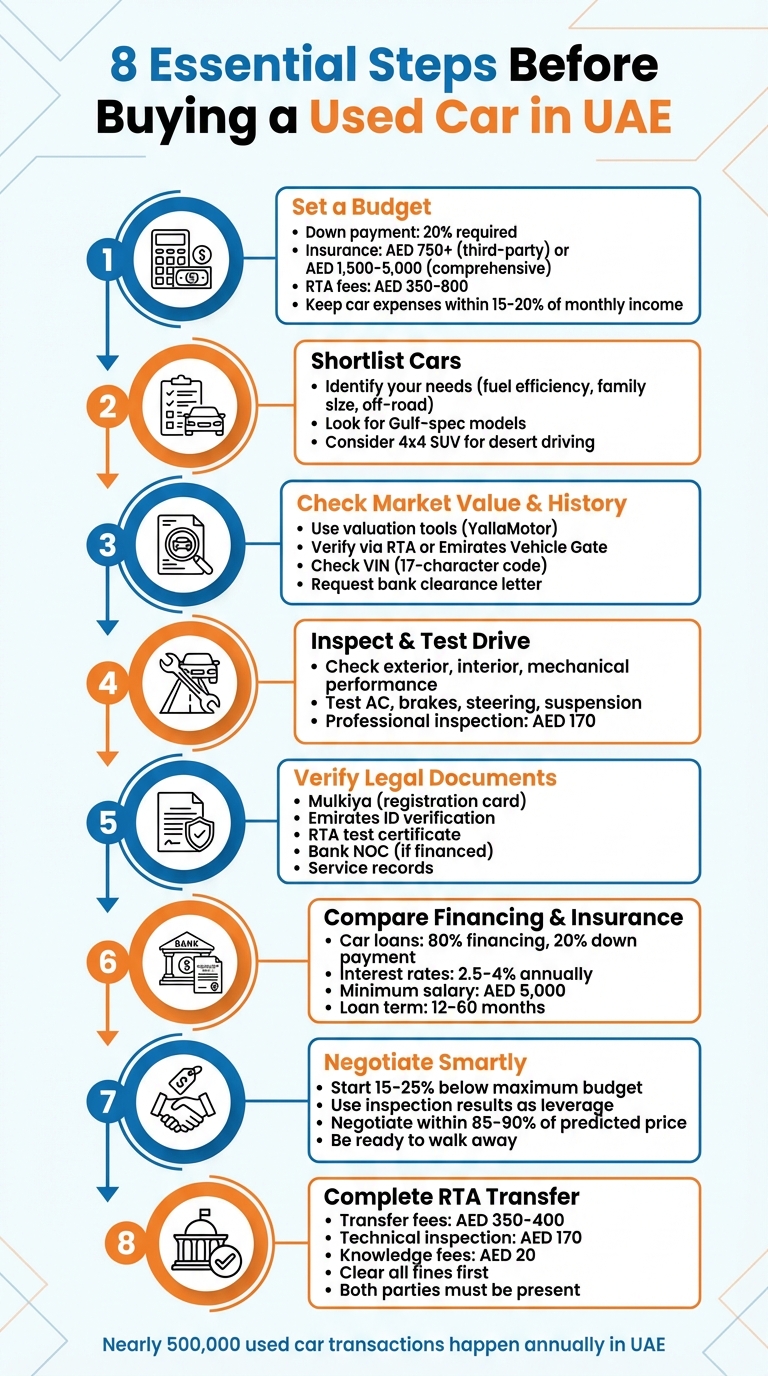

8 Essential Steps Before Buying a Used Car

Tags:

Buying a used car in the UAE can be a smart choice, but it comes with challenges like hidden issues, unclear history, or unexpected costs. To avoid these pitfalls, follow these 8 steps to make an informed and confident purchase:

-

Set a Budget: Factor in the car price, down payment (20%), loan EMIs, insurance (starting at AED 750), RTA fees (AED 350–800), and maintenance.

-

Shortlist Cars: Identify your needs (e.g., fuel efficiency, family size, off-road capabilities) and focus on Gulf-spec models for UAE conditions.

-

Check Market Value & History: Use tools like YallaMotor for fair pricing and verify the car’s history via RTA or Emirates Vehicle Gate.

-

Inspect & Test Drive: Check the car’s exterior, interior, and mechanical performance. Consider a professional inspection for added assurance.

-

Verify Legal Documents: Ensure the Mulkiya, Emirates ID, and other paperwork are accurate and complete. Check for bank clearance if financed.

-

Compare Financing & Insurance: Explore car loans with 20% down payment and compare comprehensive insurance options for coverage.

-

Negotiate Smartly: Use inspection results and valuation data to propose a fair price. Be ready to walk away if the deal isn’t right.

-

Complete Ownership Transfer: Finalize the purchase through the RTA, covering fees (AED 350–400) and technical inspection (AED 170).

8 Essential Steps to Buy a Used Car in UAE

Step by Step Car Buying Guide for the UAE 2025!

Step 1: Set a Realistic Budget

Before diving into used car listings in the UAE, it’s crucial to understand the full scope of ownership costs. The sticker price is just one part of the equation. Most UAE banks provide car loans that cover up to 80% of the car’s value, meaning you’ll need to pay a 20% down payment upfront. To avoid financial strain, experts suggest keeping your total car expenses within 15-20% of your monthly income. Once you have a clear budget, you can explore loan options and evaluate car prices confidently.

Calculate Total Ownership Costs

Don’t overlook the additional costs that come with owning a car. For example, RTA transfer fees range from AED 350 to AED 800, depending on the car’s size. Registering a used light vehicle costs approximately AED 420, and you’ll also need to budget for a mechanical inspection (AED 170), opening a traffic file (AED 220), and knowledge/innovation fees (AED 20).

When it comes to insurance, prices can vary significantly. Third-party liability insurance starts at around AED 750, while comprehensive coverage for mid-range vehicles ranges between AED 1,500 and AED 5,000. On top of that, consider Salik charges (AED 4-6 per crossing), fuel costs averaging AED 3.05 per litre, and routine maintenance expenses, which typically range from AED 300 to AED 800 every 6,000-15,000 kilometres. It’s also wise to set aside at least AED 200 per month for unexpected repairs.

Review Car Loan Options in the UAE

If you’re planning to finance your car, ensure that your monthly instalments fit comfortably within your budget. Ideally, car loan EMIs should not exceed 10-15% of your gross monthly income. Banks and financial institutions in the UAE offer various loan packages based on factors like your credit score, income, and the car’s age. Take the time to compare interest rates, processing fees, and loan terms. Online calculators can help you estimate your monthly payments, ensuring they align with your financial situation. Keep in mind that insurance premiums generally amount to 4-5% of the car’s value annually, but can rise to 7-10% for sports cars or inexperienced drivers.

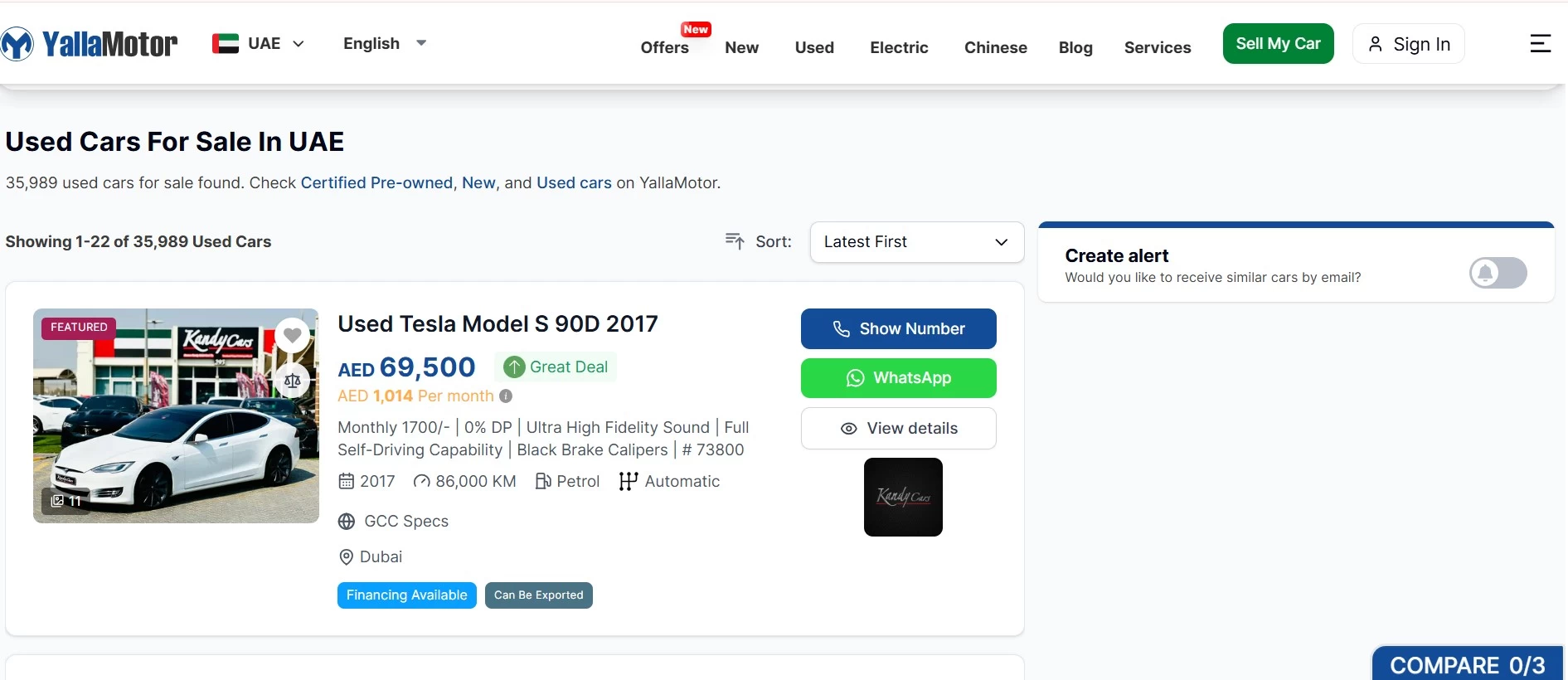

Check Car Values with Online Tools

To ensure you’re paying a fair price, use online tools like YallaMotor’s AI-powered valuation feature. These tools assess market trends, transaction data, regional factors, and vehicle history to provide an accurate estimate. Simply input details such as the car’s make, model, year, mileage, and condition for a reliable valuation. As a buyer, consider negotiating within 85-90% of the predicted price range for a fair deal. Keep in mind that these estimates don’t account for extra costs like registration, taxes, or transaction fees.

Step 2: Shortlist the Right Car

Now that you’ve set your budget, it’s time to focus on finding a car that fits your needs. The UAE’s diverse driving conditions - ranging from busy city streets to open desert highways - mean you’ll need to choose wisely.

Identify Your Needs

Think about your daily driving habits. For instance, if you’re commuting between Dubai and the Northern Emirates during rush hours, you might spend around 460 hours a year stuck in traffic. In this case, prioritising fuel efficiency and comfort is a smart move.

Family size is another key factor. UAE law requires child safety seats for kids under four and prohibits children under 12 from sitting in the front seat. If your drives often take you outside urban areas, be prepared for unexpected road hazards like camels or goats. For city driving, compact cars are easier to handle and park in tight spaces. On the other hand, if you’re heading into the desert or mountains, a 4x4 SUV with off-road capabilities is essential. Understanding these specifics will help you align vehicle features with both your daily and long-distance driving needs.

Look for UAE-Friendly Features

The UAE’s intense heat makes certain car features non-negotiable. Look for vehicles with a reliable engine, durable transmission, and an efficient air-conditioning system - especially if you plan on taking long trips or driving in desert conditions.

"Gulf-spec" vehicles are particularly suited to the region. These cars are designed for extreme temperatures, featuring larger radiators, upgraded condensers, and enhanced thermal systems, including cooling for hybrid batteries and inverters. Speaking of hybrids, they’re an excellent choice in the UAE since they’re fuel-efficient and produce fewer emissions.

Explore YallaMotor Listings

Once you know what you’re looking for, YallaMotor makes it easy to find the perfect match. Their AI-powered smart search tool allows you to enter natural language queries to refine your search. You can also filter by year, mileage, price range, and service history.

With over 1.4 million unique monthly visitors and the largest vehicle inventory in the region, YallaMotor offers a wide selection from private sellers and certified dealers. You can access detailed vehicle reports, valuations, and inspections to make an informed choice. Use these features to narrow your options down to three to five vehicles that meet your criteria before moving on to the next step.

Step 3: Check Market Value and Vehicle History

Once you've narrowed down your choices and set a budget, the next step is to dive into the car's market value and history. This ensures you’re not overpaying and helps you avoid any unpleasant surprises.

Verify Fair Market Value

Use YallaMotor's valuation tool to input details like the car's make, model, year, mileage, and condition. Compare these results with similar listings to confirm you're looking at a fair price. With nearly 500,000 used car transactions happening annually in the UAE - and that number expected to double over the next five years - you’ll find plenty of comparable options to guide your decision.

Several factors influence a car's value. For instance, vehicles with GCC specifications tend to hold higher resale prices, and an accident-free history with complete service records can significantly boost value. If a seller's price is noticeably higher than the market average without a clear reason, consider it a warning sign. Once you’ve established a fair price, turn your attention to the car's history for more detailed insights.

Review Vehicle History Records

Start by checking Emirates Vehicle Gate (evg.ae) for accident history, odometer readings, and ownership records. For Dubai-registered vehicles, you can also request the RTA's Technical Vehicle Status Certificate for AED 120. This document provides details on accidents, insurance claims, and ownership history.

The Ministry of Interior website is another useful resource, offering accident inquiry services across multiple emirates. It provides information on accident locations, frequency, and report numbers. For a more comprehensive look, you can purchase a detailed vehicle report from services like Vehicle Report or AutoData for about AED 99. These reports include local and international data, such as theft records, estimated value, and maintenance logs. Once you’ve reviewed the history, the next step is to verify the car's unique identifiers.

Verify VIN and Documentation

Locate the 17-character Vehicle Identification Number (VIN) on the car. You’ll usually find it on the dashboard, the driver’s side door jamb, or on the Mulkiya (registration card). This code is like the car's fingerprint, providing vital details about its make, model, history, and any accidents. Always ensure the VIN on the Mulkiya matches the one on the car itself. Any mismatch could signal tampering or fraud.

"A car's unique 17-character VIN code serves as its fingerprint and it contains vital information about the car, such as the model, maker, history, and any accidents." - Al-Futtaim Automall UAE

Lastly, request a bank clearance letter to confirm there are no outstanding loans tied to the vehicle. Unresolved liens can lead to costly legal complications down the road.

Step 4: Inspect and Test Drive the Car

Once you've confirmed the car's history, it's time to get hands-on. A thorough inspection can uncover issues that paperwork might not reveal.

Check Exterior and Interior Condition

Always inspect the car during daylight hours - it makes spotting imperfections much easier. Walk around the vehicle and carefully examine the paintwork for scratches, dents, rust spots, or mismatched colours. These could hint at previous accidents or subpar repairs. Pay attention to uneven panel gaps and overspray on the rubber trim, as these are potential red flags. Don't forget to check the windscreen and windows for chips or cracks, which can worsen quickly in the UAE's intense heat. Tyres are another critical area - ensure even tread wear and confirm there's at least 5 mm of tread depth remaining.

Inside, lift floor mats and seat covers to check for hidden damage, stains, or signs of water leakage. Test all dashboard controls, gauges, and the radio to ensure they work properly. Given the UAE's high temperatures, the air conditioning is a must-check - turn it on and make sure it cools efficiently. Also, inspect rubber components like door seals and bushings, as the heat can cause them to wear out faster than expected.

Once you're satisfied with the car's physical condition, it's time to see how it performs on the road.

Test Mechanical and Performance

Take the car for a spin on different types of roads - turns, traffic, potholes, and speed bumps. Listen closely for any unusual engine noises, such as rattling, ticking, or clanging, especially when idling. While driving, adjust the air conditioning at various speeds to check if it affects engine performance. Test the steering by making U-turns and full rotations, ensuring it feels smooth and responsive.

When it comes to brakes, apply gradual pressure at a safe speed. The pedal should feel steady, without vibrations, and the car should stop straight without pulling to one side. After the drive, check under the car for oil stains or leaks and watch for signs of overheating, like an overly active radiator fan. You can quickly test the suspension by pressing down on each corner of the car - if it rebounds immediately without excessive bouncing, the suspension is likely in good shape.

If you're still uncertain after your assessment, it’s wise to bring in a professional.

Get a Professional Vehicle Inspection

Even if everything seems fine, a professional inspection can uncover hidden issues you might have missed. It can also strengthen your negotiation position by identifying potential repair costs. YallaMotor offers detailed inspection services, or you can visit a trusted inspection centre in the UAE. Professionals will check critical safety components like brakes, tyres, airbags, and steering to ensure the car meets safety standards. This extra step can give you peace of mind before making your final decision.

Step 5: Verify Legal Documents and Ownership

Once you've assessed the car's condition, it's time to ensure all legal documents are in order. Missing or incorrect paperwork can lead to delays or even hint at potential fraud, so this step is critical.

Review Required Documents

The current Mulkiya (vehicle registration card) is the most important document. It confirms ownership and includes key details about the vehicle. Additionally, you'll need a recent passing certificate from an RTA-approved testing centre to confirm the car meets safety and technical standards. Ask the seller for their original Emirates ID to ensure their identity matches the name on the Mulkiya.

For proof of the transaction, a bill of sale is essential. If the car was financed, the seller must provide a No-Objection Certificate (NOC) from the bank, confirming all outstanding loans are cleared. For electric vehicles, starting in 2025, a battery health certificate from an authorised service centre will also be mandatory.

Although not legally required, service records and warranty papers can give you valuable insight into the car's maintenance history. Collecting these documents will provide a solid foundation for verifying ownership and the car's condition.

Confirm the Seller's Ownership

To ensure the seller is the rightful owner, use official government portals for verification. Check that the seller’s Emirates ID matches the details on the Mulkiya. Platforms like the RTA website, Emirates Vehicle Gate (EVG), or TAMM allow you to verify ownership by entering the chassis number (VIN) or registration number.

You can also request an RTA technical vehicle status certificate. This requires the current owner’s approval, which is granted via a code sent to their registered mobile number - adding an extra layer of security. Starting in 2025, digital insurance verification through the Al Etihad Credit Bureau will be a mandatory step, further simplifying compliance.

For the official transfer, both you and the seller must be physically present to complete identity verification, often handled through UAE Pass.

Keep Track with a Comparison Table

If you're evaluating multiple cars, consider using a comparison table to keep track of the documents provided by each seller. Include columns for the Mulkiya, RTA test certificate, Emirates ID verification, bank NOC (if applicable), service records, and warranty papers. This makes it easy to spot which vehicles have complete documentation and which might raise red flags. Staying organised not only simplifies the verification process but also speeds up the final steps of the transfer.

Step 6: Compare Financing and Insurance Options

Once your documentation is verified, it’s time to make decisions that will shape your financial commitments. Choosing the right financing and insurance options can save you thousands of dirhams and help you avoid potential issues down the road.

Understand UAE Car Financing

In the UAE, banks typically require a 20% down payment for car loans, with repayment terms ranging from 12 to 60 months. Interest rates for new car loans usually range between 2.5% and 4% annually, while rates for used cars are slightly higher. It’s important to check whether the interest is calculated as a flat rate or on a reducing balance. While flat rates might seem lower, they don’t always reflect the actual cost of the loan.

To qualify for a car loan, applicants must meet the following requirements:

-

Be at least 21 years old

-

Hold a valid UAE residence visa

-

Earn a minimum monthly salary of AED 5,000 (or AED 3,000 for used cars)

-

Provide documents such as an Emirates ID, passport, salary certificate, 3–6 months of bank statements, and a UAE driving licence

Additionally, banks charge a 1% arrangement fee and require mandatory comprehensive insurance for the loan’s duration. To maximise your options, ask your dealer to gather financing quotes from at least two or three banks. Getting pre-approval can also strengthen your negotiating position.

Once financing is sorted, it’s time to evaluate insurance options to protect your car.

Compare Insurance Plans

In the UAE, third-party liability insurance is mandatory by law. This type of coverage protects against damages you may cause to others but does not cover your own vehicle. For broader protection, comprehensive insurance is the preferred choice. It covers damage to your car as well as risks like theft, fire, vandalism, and natural disasters. If you’re financing your vehicle, banks usually require comprehensive insurance with the bank listed as a co-beneficiary throughout the loan term.

Insurance premiums are influenced by several factors, including:

-

Your driving history

-

The car’s age and value

-

The deductible amount, typically ranging from AED 500 to 2,000

When comparing policies, pay close attention to what’s included, such as emergency roadside assistance, and what’s excluded. This ensures you’re getting the coverage you need.

Use YallaMotor Financing and Insurance Services

To simplify your financing and insurance journey, YallaMotor has partnered with FinMart to offer a digital financing platform. This service allows you to compare rates from multiple banks simultaneously, saving you the hassle of visiting each one individually. The platform provides access to competitive rates, exclusive deals tailored for YallaMotor users, and quick online approvals. It’s a convenient way to streamline the entire car financing and purchase process.

Step 7: Negotiate and Compare Final Options

Seal the deal by using inspection findings and market research to your advantage. With all your groundwork in place, it's time to negotiate effectively and weigh your choices carefully.

Leverage Inspection and Valuation Data

Inspection results can be your best friend during negotiations. If a mechanic points out issues like worn-out brake pads, a leaking seal, or tyres nearing replacement, calculate the repair costs and use those figures to propose a lower price. Similarly, if your market research shows that the seller's price is higher than the average, bring that data to the table. Sellers are more likely to take you seriously when you back your offer with solid facts rather than vague opinions.

Start your negotiations at 15–25% below your maximum budget. For instance, if AED 50,000 is your limit, consider opening with an offer around AED 42,500. However, avoid going too low, as this might offend the seller and shut down discussions prematurely.

Use a Comparison Table for Clarity

If you're deciding between multiple options, a simple comparison table can help you stay objective. Include key details like mileage, asking price, inspection results, service history, and total ownership costs (insurance, maintenance, etc.). For example, a 2019 Honda Accord with 85,000 km, complete service records, and a price of AED 52,000 might be a smarter buy than a 2018 model with 110,000 km priced at AED 48,000 but with an incomplete service history. Japanese-spec cars like the Accord, Camry, and Land Cruiser are especially popular in the UAE due to their reliability and fuel efficiency, which helps them retain value longer.

While a comparison table can guide your decision, don't hesitate to walk away if the deal doesn't align with the facts.

Know When to Walk Away

If the seller refuses to negotiate despite clear evidence of issues or won't provide full documentation, it's best to move on. The UAE's used car market is vast, so there's no need to settle for a deal that feels off. Set a firm maximum price before starting negotiations, keeping in mind extra costs like RTA transfer fees and first-year maintenance. Sticking to your budget and being willing to walk away can save you from unexpected repair bills or buyer's remorse down the line.

These steps will ensure you're well-prepared for a smooth ownership transfer in the next phase.

Step 8: Complete Ownership Transfer at RTA

After completing inspections and finalising the deal, the last step is to make the transfer of ownership official through the RTA (Roads and Transport Authority). This involves a few essential steps, including paperwork, fees, and a technical inspection. Here’s how to navigate this process smoothly.

RTA Transfer Checklist

Before heading to the RTA, make sure to clear any outstanding fines. Both the buyer and seller must bring their original Emirates IDs. If the seller cannot be present, a notarised sales agreement is required. The car must also pass a technical inspection, which costs AED 170 and checks brakes, lights, tyres, and emissions. If the vehicle is under financing, the seller must provide a No Objection Certificate (NOC) from their bank. Additionally, you’ll need to activate your insurance policy beforehand, as proof of insurance is mandatory at the RTA counter.

Transfer Fees and Registration Details

Be prepared for the fees associated with the transfer. For light vehicles, transfer fees typically range from AED 350 to AED 400, with an additional AED 170 for the inspection and AED 20 for knowledge fees. If you need new number plates, the cost is AED 35 for short plates or AED 50 for long ones, while luxury plates can go up to AED 500.

There are some perks and penalties to keep in mind:

-

If the transfer is completed more than 60 days before the registration expires, you’ll save 15% on fees.

-

Hybrid and electric vehicles benefit from a 50% fee reduction and free first-year registration.

-

Vehicles with over 150,000 km on the odometer incur a AED 100 emission surcharge.

-

Late transfers come with a penalty of AED 50 per day.

Keep Your Records Safe

Once the transfer is complete, make sure to securely store all relevant documents, including your updated Mulkiya, RTA receipts, inspection reports, and the purchase agreement. These records are critical for future renewals, insurance claims, or if you decide to sell the vehicle later. It’s also a good idea to keep digital copies on your phone or cloud storage for easy access when needed.

Conclusion

Purchasing a used car in the UAE requires careful planning and attention to detail. From setting a budget to completing the RTA transfer, each step plays a critical role in ensuring a safe and successful transaction. Skipping any part of the process could expose you to financial losses, legal complications, or even safety hazards.

It's essential to verify the car's history thoroughly and arrange for a professional inspection. This helps protect you from potential fraud and ensures the car meets all regulatory requirements.

Additionally, taking the time to research and compare options is key. Understanding market prices, financing solutions, and insurance plans empowers you to make well-informed decisions. By relying on trusted resources and staying diligent, you can navigate every stage of the process with confidence.

FAQs

What documents should I check before purchasing a used car in the UAE?

When purchasing a used car in the UAE, making sure all the necessary documents are in order is a must. Here's what you need to check:

-

Emirates ID and a valid UAE driving licence to verify identity and driving eligibility.

-

The original car registration card (Mulkiya) or a transfer certificate if the ownership has changed.

-

A recent vehicle inspection report from an authorised testing centre to confirm the car's condition.

-

The car’s service history, which provides insight into its maintenance and care.

-

A valid insurance policy covering the vehicle.

It’s also wise to ensure the car has no unpaid fines or outstanding loans on its record. By verifying these details, you can avoid potential issues and enjoy a hassle-free buying experience.

How can I make sure I'm paying the right price for a used car in the UAE?

To make sure you're getting a fair deal on a used car in the UAE, start by looking into the current market value of similar models in the area. Compare prices from private sellers and dealerships, keeping in mind key factors like the car's condition, mileage, and whether it’s a GCC specification model, which is often preferred for the region.

Next, dig into the car's history. Use its VIN to check for past accidents or service records, and consider hiring a professional mechanic to inspect the vehicle for any hidden problems. Going through the car's complete service records can give you a clearer picture of how well it’s been maintained. Armed with this information, you’ll be better equipped to negotiate and strike a fair deal in AED.

What should I consider when selecting car insurance for a used vehicle in the UAE?

When selecting car insurance for a used vehicle in the UAE, it’s important to weigh a few essential factors to ensure you get coverage that fits your needs and budget.

Start by considering the value and age of the car. If your vehicle is newer or holds a higher market value, comprehensive insurance might be the better choice to cover a wider range of risks. On the other hand, for an older car, third-party insurance may be more practical and cost-effective. Your driving history and claims record also play a big role in determining your premium. A clean record not only reflects safer driving but can also help lower your insurance costs.

Don’t forget to factor in your location and the driving conditions you typically encounter. These elements can influence the level of risk and, consequently, the type of insurance you might need. Finally, take the time to compare policies to strike the right balance between coverage and affordability, ensuring the plan aligns with your requirements and adheres to UAE regulations.

Looking for a used car in Dubai or new car deals? Explore YallaMotor’s verified listings today.